As a medical courier, you’re not just earning money —

you’re running a small business.

That means big tax deductions are available to you. Claiming them correctly can help you keep thousands more of what you earn each year.

Here’s a simple guide to the must-claim write-offs for medical couriers 👇

🚗 Mileage & Fuel — Your #1 Tax Deduction

You can deduct every mile driven for:

-

Pickups and dropoffs

-

Traveling between facilities

-

Route to/from dispatch

-

Training and onboarding trips

2025 IRS standard mileage rate:

➡️ $0.67 per mile (example if unchanged)

Most couriers drive 20,000+ business miles yearly:

🟢 That’s $13,400+ in deductions 🚀

💡 Tip: Use an app like Everlance to log automatically.

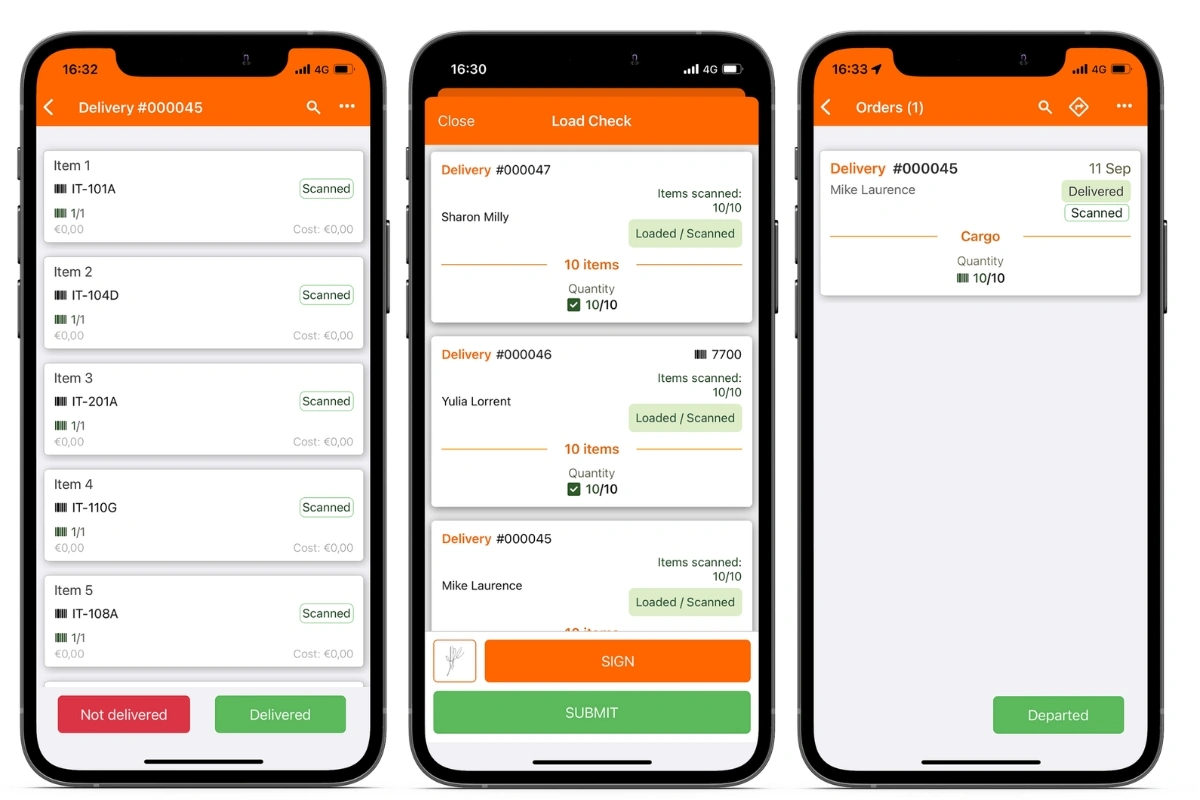

🧊 Delivery Equipment & Supplies

Anything used specifically for deliveries is deductible:

✅ Insulated coolers

✅ Blue ice packs

✅ Gloves & sanitizing supplies

✅ Clipboard or delivery bag

✅ Reflective vest

You only need a receipt ✨

📱 Apps & Mobile Expenses

You can deduct the business percentage of:

-

Phone bill 📱

-

GPS & route apps

-

Mobile accessories (mount, charger)

If 70% of your phone use is for courier work →

➡️ 70% becomes a write-off ✅

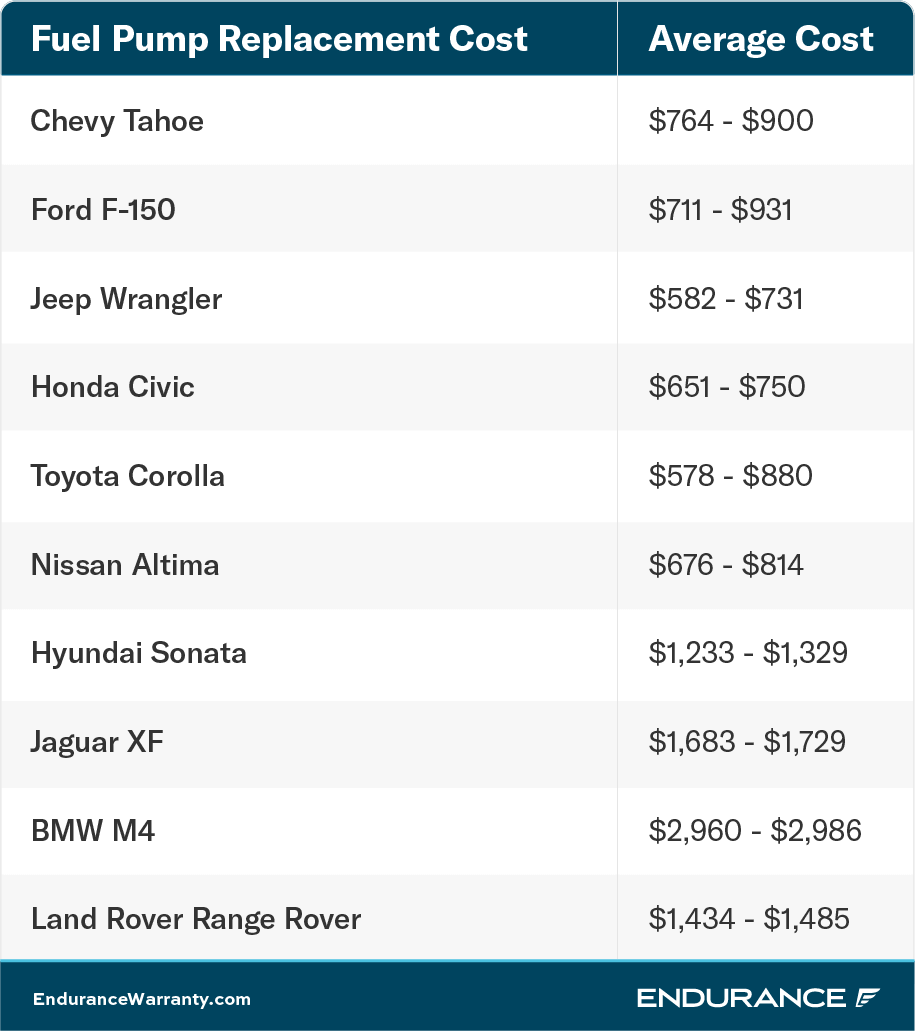

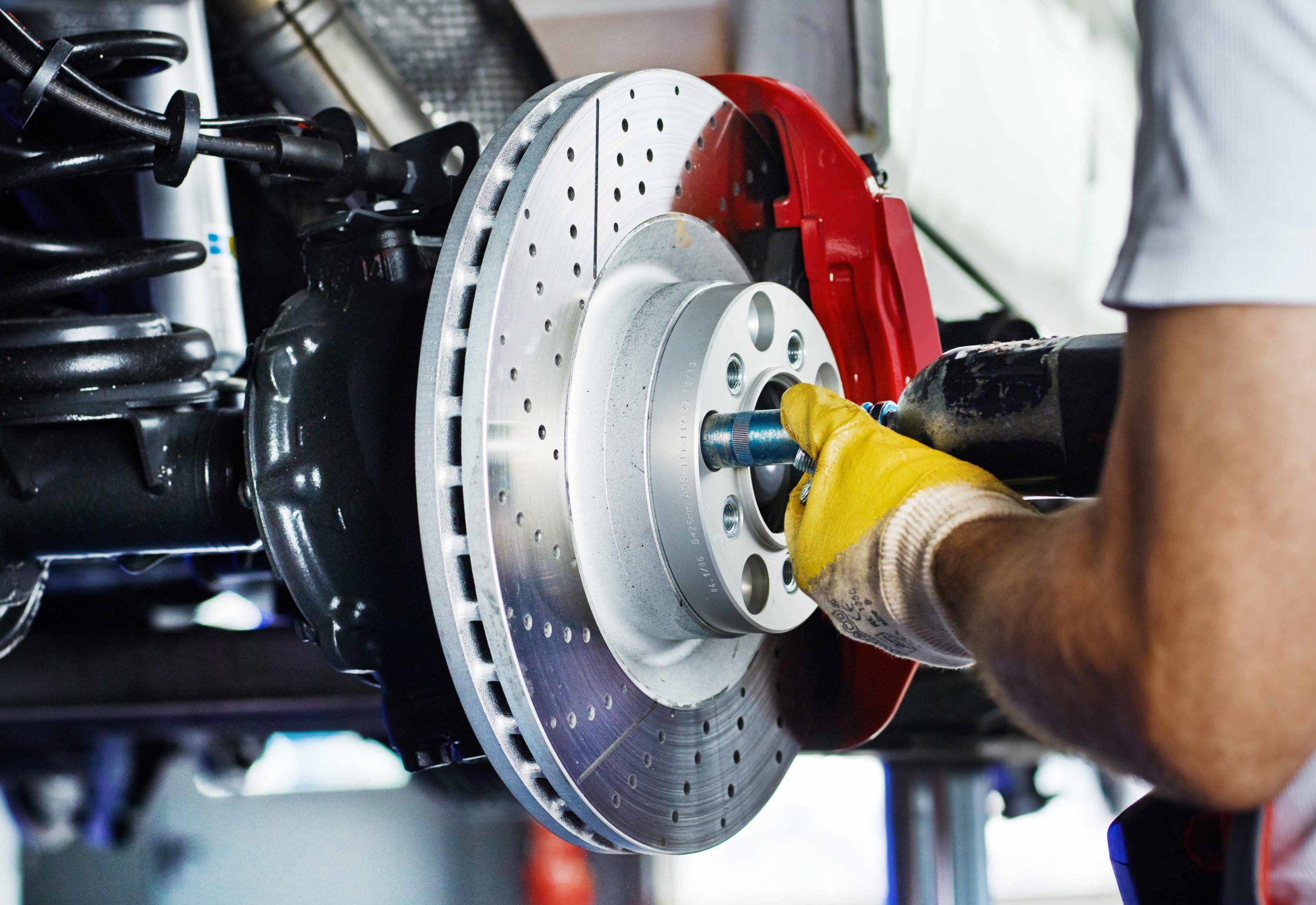

🛠️ Vehicle Expenses & Maintenance

IRS allows either:

1️⃣ Standard Mileage Deduction (most common)

or

2️⃣ Actual Vehicle Expenses, such as:

-

Repairs

-

Tires

-

Oil changes

-

Car washes

-

Insurance

Choose whichever saves you the most 💡

(A tax pro can compare both.)

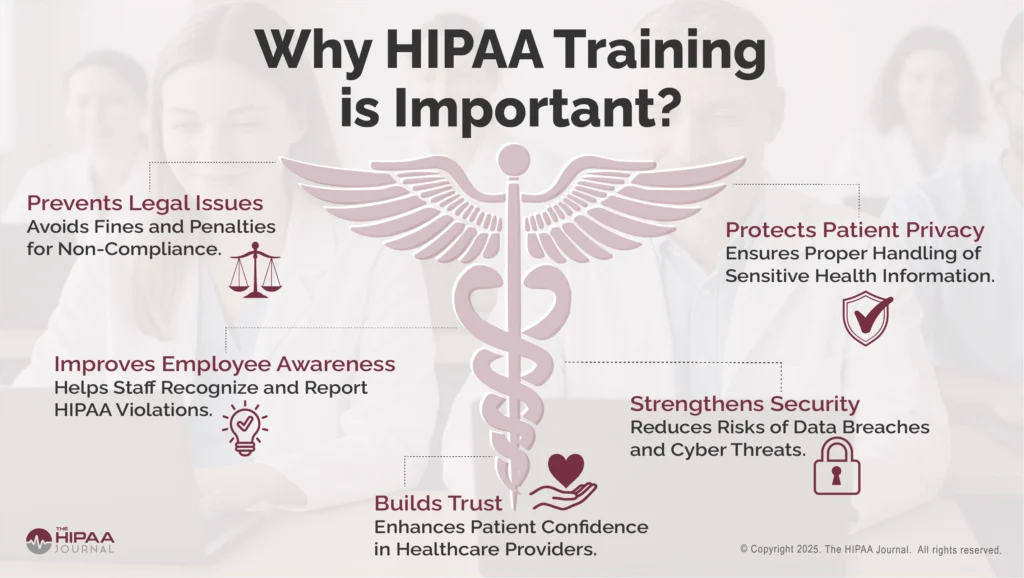

📝 HIPAA & Professional Training

Any training required for your job counts:

✅ HIPAA certification

✅ On-boarding courses

✅ Compliance training

✅ Safety certifications

Small investment → big deduction →

💵 Home Office (If You Dispatch from Home)

If you manage courier paperwork or scheduling from home, you may deduct a portion of:

-

Rent / mortgage

-

Utilities & internet

-

Workspace furniture

Not required to have a separate room —

Just a dedicated space for business activity ✅

🧾 Receipt + Mileage Logging = More Money Saved

A simple system keeps you audit-proof:

-

Mileage tracking app

-

Monthly folder for receipts

-

Quick note on business purpose

Professional couriers treat taxes like found income 💸

✅ Keep What You Earn

If you’re a medical courier…

You deserve to keep every dollar possible.

These write-offs often save couriers:

💰 $3,000–$8,000 per year

(depends on mileage + expenses)

That’s money back in your pocket — not the IRS.